If you are interested in Blockchain, you may already know its famous application – Decentralized Finance, known as DeFi. It is expected to be an affordable, safe, and convenient alternative to traditional banking services very soon. Sounds interesting?

Check our article now to understand decentralized finance technology and its future!

What Is DeFi?

As its name implies, decentralized finance takes advantage of the decentralization of Blockchain technology to create a peer-to-peer crypto universe for users to keep and trade their assets digitally – without intermediaries. Transactions become transparent, cheap, and open to anyone with an internet connection.

In particular, decentralized finance works based on four key terms:

- Smart contracts

In a blockchain, smart contracts are encrypted to validate and execute automatically. They cannot be exploited or altered.

- Decentralized finance protocols

Protocols group multiple smart contracts to align with real-world situations and execute particular tasks.

- Governance tokens

Decentralized finance projects use cryptocurrencies as governance tokens to distribute the powers and rights of users. For instance, users can vote to change the project’s protocols, operations, incentives, etc.

- Decentralized application, or dApp

The app runs on a network of peer-to-peer computers or in a blockchain to help interact with the protocols.

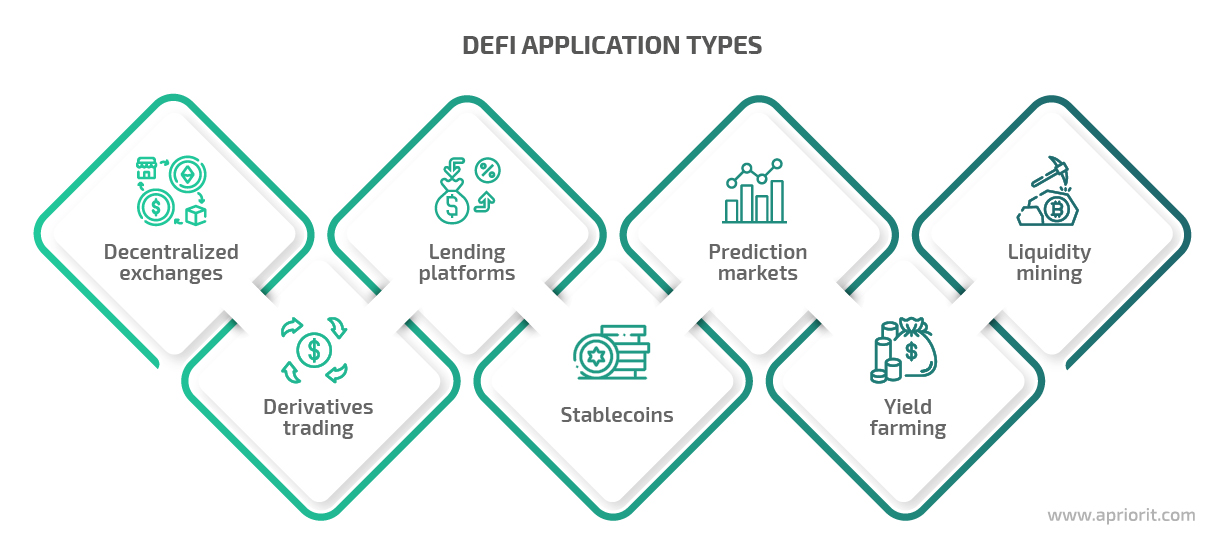

Applications of Decentralized Finance in Our Real Life

DeFi mainly supports the financial ecosystem for various purposes, as follows:

- Decentralized exchanges (DEXs)

This is the most common application of decentralized finance. Users exchange cryptocurrency in a peer-to-peer marketplace to improve funds’ transfer and custody.

- Derivatives trading

Derivative trading uses the decentralized-finance blockchain to derive the value of intelligent contracts from the performance of underlying entities such as options, futures, collateralized loans, etc.

- Lending platforms

In the decentralized finance world, any user can become an instant lender to loan their assets and generate interest, relying on smart contracts. The lending process is through lending pools where borrowers must provide sufficient collateral.

- Stablecoins

Stablecoins hold stable prices as they are tied to non-crypto assets such as euros or dollars. Those coins help raise funds for DeFi projects.

There are three stablecoins for you to consider: Fiat-backed coins, commodity-backed coins, and cryptocurrency-backed coins.

- Prediction markets

DeFi prediction markets help users to trade the results of events, for example, financial situations or sports games.

- Yield farming

Besides individuals, liquidity businesses stake or lend crypto assets to receive incentives for additional cryptocurrencies as governance tokens or transaction fees.

- Liquidity mining

This is another form of yield farming in which owners of decentralized-finance assets provide liquidity to the decentralized exchanges and get both transaction fees and the additional tokens of the platform.

Differences Between DeFi and A Traditional Bank

Here we provide a comparison to help you understand the potential of DeFi.

The accessibility

Users have to go to traditional banks to open an account. Unfortunately, banks are not always available in the countryside or remote areas. If available, banks also have limited trading hours.

Instead, DeFi platforms are accessible to any people connecting to the internet – anywhere and at any time.

Ownership of the money

In both cases, the money is yours.

If you use conventional banks, however, funds are kept on the bank’s side, and you need to contact them to make any transactions. Banks might block you from getting paid in case of any violations.

Now, imagine using a DeFi platform. You have complete control over funds, meaning you decide where and how to spend tokenized money.

Intermediaries and Processes

The most significant difference between DeFi and a traditional bank is the involvement of intermediaries.

There are intermediaries and a bund of manual processes at banks that lengthen some money transfers for days. Meanwhile, DeFi platforms completely cut out and replaced intermediaries with automatic smart contracts. By doing so, users can complete DeFi transactions in minutes and with improved transparency.

Security

Ideally, both bank transactions and DeFi transactions are secure.

While banks have tightly-controlled processes to facilitate your money, there are many regulations to protect your rights and assets at banks. DeFi uses secure blockchain technology. Data in the blockchain is tokenized and almost impossible to be altered.

From our point of view, banks are more secure; cybercriminals are trying to exploit the data. They hacked some DeFi projects and caused a loss of hundreds of millions of dollars. There are almost no regulations related to DeFi, meaning lower consumer protections than traditional banks.

To Sum Up …

Although traditional banks are still the mainstream for financial transactions, the concept of DeFi is very profitable when we weigh its pros and cons. You can use it now to keep and facilitate your money, as long as you follow best practices to enhance DeFi security.

Thus, check it out now!

4 minutes read

4 minutes read